Government of British Columbia Government Organization ● 51,779 Likes

Starting in January 2017, BC is partnering with first-time homebuyers. With the new BC HOME Partnership program, you could be eligible for a down payment loan of up to 5% of the purchase price of a home. #BCFirst http://ow.ly/lSmN307cBRr

Backgrounders

B.C. Home Owner Mortgage and Equity Partnership program details

Am I eligible for a partnership loan?

The program supports eligible first-time homebuyers who are approved for an insured high-ratio first mortgage. To qualify for the program, all individuals on title must:

- Have been a Canadian citizen or permanent resident for at least five years.

- Have resided in British Columbia for at least one year immediately preceeding the date of application.

- Be a first-time buyer who has not owned an interest in a residence anywhere in the world at any time.

- Use the property as their principal residence for the first five years.

- Purchase a home that has a purchase price price of $750,000 or less (excluding taxes and fees).

- Obtain a high-ratio insured first mortgage on the property for at least 80% of the purchase price.

- Have a combined, gross household income of all individuals on title not exceeding $150,000.

- Have saved a down payment amount at least equal to the loan amount for which the buyer applied.

What do I do and how do I apply?

Step 1: Get preapproval for an insured first mortgage from your financial lending institution.

Step 2: Apply to BC Housing for the B.C. Home Owner Mortgage and Equity Partnership program loan. If you are eligible, you will receive confirmation of eligibility and Homebuyer’s Kit, which includes information for your lender, real estate licensee, and lawyer/notary public.

Step 3: Find your home and provide the details of your planned purchase to BC Housing for approval.

Applications for the program will be accepted starting Jan. 16, 2017, for purchases that will close on or after Feb. 15, 2017.

What information will I need to apply?

Buyers can begin gathering the documents they’ll need to submit an online application. Buyers will need:

- Proof of status in Canada and residency in British Columbia.

- Secondary identification (must include your photo).

- Proof of income and tax filings.

- Insured first mortgage pre-approval.

More information about these requirements: https://homeownerservices.bchousing.org/

Support for first-time buyers using the B.C. Home Owner Mortgage and Equity Partnership program

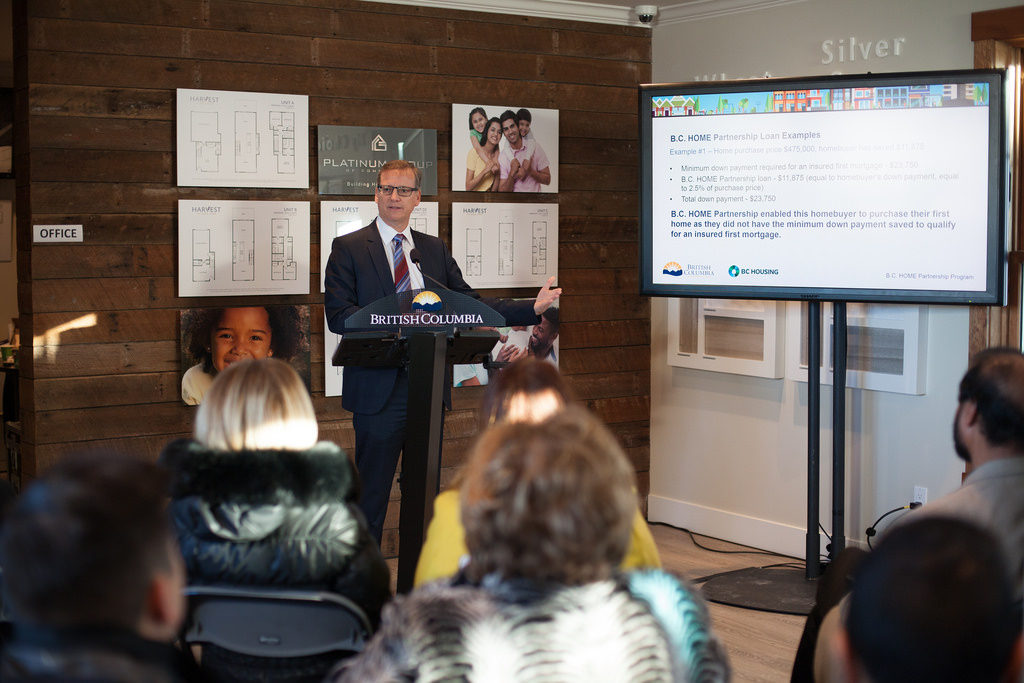

Example #1: Home purchase price – $475,000

This first-time buyer has saved $11,875 towards their down payment, or 2.5% of the home’s purchase price. Through the progam, the Province will contribute $11,875, equal to the buyer’s 2.5% down payment. This brings the total down payment to $23,750 or 5% of the home’s purchase price, as required by Canada Mortgage and Housing Corporation. This loan is interest and payment-free for the first five years.

As a first-time buyer, this person can also qualify for the First Time Home Buyer’s exemption for the Property Transfer Tax, saving: $7,500.

The B.C. HOME Partnership program enabled this buyer to purchase their first home as this buyer did not have the minimum down payment saved to qualify for an insured first mortgage.

Example #2: Home purchase price – $600,000 This first-time buyer has saved 5% of the home’s purchase price towards their down payment, or $30,000. Canada Mortgage and Housing Corporation requires a 5% down payment for the first $500,000, and 10% for the remaining portion. This means the minimum down payment required for a home valued at $600,000 is $35,000. This loan is interest and payment-free for the first five years.

If this is a newly built home, the buyer can also qualify for the Newly Built Home Exemption for the Property Transfer Tax, saving: $10,000.

The B.C. HOME Partnership program will meet this buyer’s contribution of $30,000, bringing their total down payment to $60,000, and enabling this buyer to purchase their first home as they had not yet saved the minimum down payment required to qualify for a insured first mortgage.

Example #3: Home purchase price – $750,000

The first-time buyer in this example has saved 7% of the home’s purchase price as a down payment, or $52,500.

Canada Mortgage and Housing Corporation requires a 5% down payment for the first $500,000, and 10% for the remaining portion. This means the minimum down payment required for a home valued at $750,000 is $50,000.

The Province will meet the buyer’s contribution up to 5% of the home’s purchase price. In this example, the program will contribute $37,500 towards the down payment, allowing this buyer to put a total of $90,000 towards the down payment of their first home.

Assuming a 3% interest rate, this buyer will save $5,201 in interest payments during the first five years of their mortgage compared to if the buyer had purchased the home without the program.

In addition, if this is a newly built home, the buyer can also qualify for the Newly Built Home Exemption for the Property Transfer Tax, saving: $13,000.