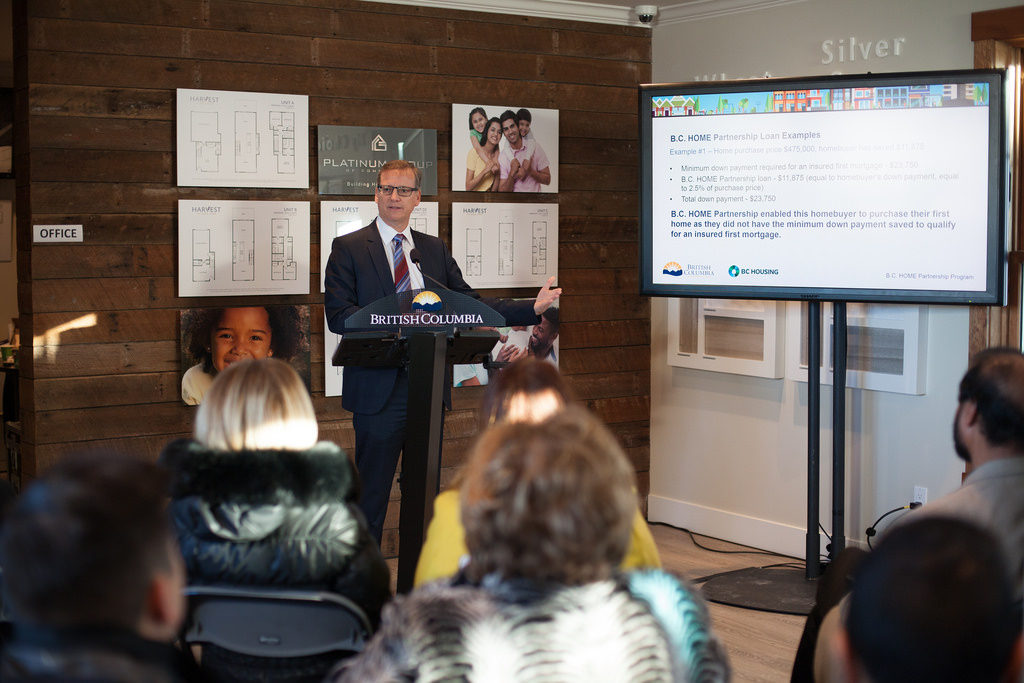

Example #1: Home purchase price – $475,000

This first-time buyer has saved $11,875 towards their down payment, or 2.5% of the home’s purchase price. Through the progam, the Province will contribute $11,875, equal to the buyer’s 2.5% down payment. This brings the total down payment to $23,750 or 5% of the home’s purchase price, as required by Canada Mortgage and Housing Corporation. This loan is interest and payment-free for the first five years.

As a first-time buyer, this person can also qualify for the First Time Home Buyer’s exemption for the Property Transfer Tax, saving: $7,500.

The B.C. HOME Partnership program enabled this buyer to purchase their first home as this buyer did not have the minimum down payment saved to qualify for an insured first mortgage.

Example #2: Home purchase price – $600,000

This first-time buyer has saved 5% of the home’s purchase price towards their down payment, or $30,000. Canada Mortgage and Housing Corporation requires a 5% down payment for the first $500,000, and 10% for the remaining portion. This means the minimum down payment required for a home valued at $600,000 is $35,000. This loan is interest and payment-free for the first five years.

If this is a newly built home, the buyer can also qualify for the Newly Built Home Exemption for the Property Transfer Tax, saving: $10,000.

The B.C. HOME Partnership program will meet this buyer’s contribution of $30,000, bringing their total down payment to $60,000, and enabling this buyer to purchase their first home as they had not yet saved the minimum down payment required to qualify for a insured first mortgage.

Example #3: Home purchase price – $750,000

The first-time buyer in this example has saved 7% of the home’s purchase price as a down payment, or $52,500.

Canada Mortgage and Housing Corporation requires a 5% down payment for the first $500,000, and 10% for the remaining portion. This means the minimum down payment required for a home valued at $750,000 is $50,000.

The Province will meet the buyer’s contribution up to 5% of the home’s purchase price. In this example, the program will contribute $37,500 towards the down payment, allowing this buyer to put a total of $90,000 towards the down payment of their first home.

Assuming a 3% interest rate, this buyer will save $5,201 in interest payments during the first five years of their mortgage compared to if the buyer had purchased the home without the program.

In addition, if this is a newly built home, the buyer can also qualify for the Newly Built Home Exemption for the Property Transfer Tax, saving: $13,000.

The Province is increasing the home owner grant threshold to $1.6 million, helping keep property taxes affordable for families and ensuring most home owners will continue to receive the full grant this year, Finance Minister Michael de Jong announced today.

The Province is increasing the home owner grant threshold to $1.6 million, helping keep property taxes affordable for families and ensuring most home owners will continue to receive the full grant this year, Finance Minister Michael de Jong announced today.