I recently came across an article in the Canadian Real Estate Wealth online magazine that touched on an area that I believe is incredibly important to the mortgage applicants in Canada and the industry as a whole. Early in my mortgage education I realized that brokers are constantly standing up for the homebuyers in Canada, where as the banks are trying to protect themselves and their money, without fully understanding the homebuyer and their needs.

I recently came across an article in the Canadian Real Estate Wealth online magazine that touched on an area that I believe is incredibly important to the mortgage applicants in Canada and the industry as a whole. Early in my mortgage education I realized that brokers are constantly standing up for the homebuyers in Canada, where as the banks are trying to protect themselves and their money, without fully understanding the homebuyer and their needs.

The government and the banks want to eliminate the risks of foreclosures and mismanaged mortgages. Their solution to the problem is to make it more difficult for the public to get mortgage approval. This includes lowering the maximum amortization periods, increasing the required down payments, and lowering the available home equity that can be withdrawn.

We have recently experienced changes in the past three years with the amortization period dropping from 40 years to 35 in 2008 and again in March of 2011 from 35 to 30 on high ratio mortgages. The down payment for rental properties was also increased from 5% to 20% in 2009 and the maximum home equity borrowing decreased from 90% to 85% in 2011.

These changes were implemented to “protect” the consumer from a mortgage melt down. The consumer would be in a better position to reasonably afford and manage their property should interests rates be higher at renewal or if their property values drop below their purchase price. The government also believes that these changes will help to assist Canadians on interest payments over the long-term of their mortgage. An example they used in 2011 was a $300,000 mortgage with 5% down on a 30-year amortization; the monthly payment would increase $97.00 from a 35-year amortization, therefore equating a saving of over $55,000 on interest over the life of the loan.

Although these are great precautionary elements to consider for the long term, the brokers of the mortgage industry believe that we are not considering the whole picture when it comes to protecting Canadians from overextending themselves.

The government has taken the secured credit and restricted its use, while not fully considering the implications that unsecured debt has on the consumer’s budget. It has never been easier to get a credit card, whether you are a student or an individual with a credit concerned past, you can usually be approved for a credit card or an increase to your limit with one phone call. Credit that usually has outstanding interest rates ranging from12-29% and can be used on a wide variety of poor purchasing behaviours.

Mortgage loans, secured by the property, have a substantially lower interest rate, currently averaging between 2-5%. Mortgages can provide a very secure and smart investment strategy for Canadians. The monthly investment continually adds equity to the consumer’s financial portfolio, while providing a place to live and having an invested ownership of real estate. Rather than continually restricting Canadians on their ability to be approved for mortgages, there should be some consideration on how to provide financial literacy in the management of secure versus unsecured debt.

As mentioned in Canadian Real Estate Wealth by Vernon Clement Jones, in his article “Brokers and bankers square off on 30-year amortization”, discussions by the Big Five economist were suggesting that the government might need to implement a reduction in the maximum amortization to 25 years, to curtail the growth of consumer debt. The banks argue, that if you can’t afford a 25-year mortgage versus a 30-year, that you shouldn’t be buying a home. The brokers have positioned that the 30-year allows the property investor to have greater cash flow to maximize their bang for their buck; that the change would not necessarily impact the buyer’s affordability, but limit the cash flow or economic impact of our Canadian investors.

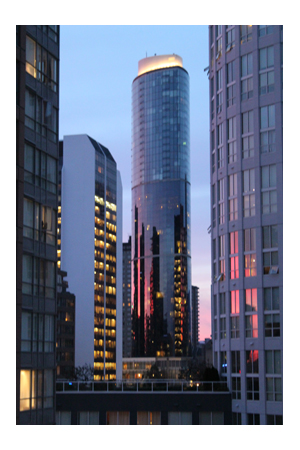

I believe that by lowering the 30-year amortization to 25-year would actually be detrimental to our economy and hinder an incredibly sensitive demographic that should be buying – the first-time homebuyer. These amortization restrictions are not as harsh in other economic regions, however, in the Metro Vancouver area, the 5 years can be a significant factor of whether an individual or couple can afford to get into the market or into a desired area.

Let’s take the earlier example from 2011 of the $300,000 mortgage and equate it to an average 5-year term mortgage rate. You will see that by lowering the amortization to 25 years, the amount of interest paid by homeowners from a 30 year to 25 would be reduced by approximately $33,000. However, this will effectively increase the monthly payment by $155.00. A significant amount that can easily eliminate qualified and solid mortgage clientele to pass on investing in a home of their own. If you consider just a year ago, when 35-year terms were available, the monthly payment difference to a 25-year term is nearly $265.00! These are big dollars when we are considering a community that is associated with an exceptionally high cost of living in comparison to the rest of the nation, not to mention that in our example, a $300,000 property, is a value well below the average sale price for property sold in the Metro Vancouver area.

| Table 1: Example on how amortization affects the monthly payment and total interest paid on a $300,000 mortgage loan. |

| Amount |

Interest Rate |

Amortization |

Monthly Payment |

Interest Paid |

| $300,000 |

3.39% |

35 |

$1216.75 |

$211,033.08 |

| $300,000 |

3.39% |

30 |

$1324.84 |

$176,944.14 |

| $300,000 |

3.39% |

25 |

$1480.45 |

$144,133.73 |

| Table 2: Example on how amortization affects the monthly payment and total interest paid on a $590,000 mortgage loan – the average property price in Metro Vancouver $620,000 minus ~5% down payment). |

| Amount |

Interest Rate |

Amortization |

Monthly Payment |

Interest Paid |

| $590,000 |

3.39% |

35 |

$2392.93 |

$415,031.72 |

| $590,000 |

3.39% |

30 |

$2605.53 |

$347,990.15 |

| $590,000 |

3.39% |

25 |

$2911.54 |

$283,462.99 |

Changes to the amortization are affecting homebuyers. Homebuyers that we need to have in the market, both to maintain growth in the industry, but also to have them to be investing in themselves, the community, and our economy as a whole. Homeowners tend to invest, make improvements, and value their home and community. They are not only making a conscious effort to commit to a home, but to a city and a way of life.

So why are limitations continually being placed on investments that can provide huge returns and offer subsidiary benefits to our community as a whole? In addition, a mortgage loan also offers a number of support resources such as brokers, real estate agents, insurance companies, etc. to assist homebuyers to make smart decisions or help them find solutions if issues arise. Our focus, therefore, should be on educating and managing the access and availability to unsecured debt, such as credit cards, which usually provide no investment returns to consumers, carry high interest rates, and can easily impact the financial security of consumers on a number of levels. We need to assist Canadians to be smarter with money rather than continually implementing regulations that restrict growth, expansion and investing as a nation.

There has been a great deal of talk on mortgages lately. Unfortunately, most with negative perspectives. The following headlines have been consuming the mortgage industry over the past couple of weeks:

There has been a great deal of talk on mortgages lately. Unfortunately, most with negative perspectives. The following headlines have been consuming the mortgage industry over the past couple of weeks:

I recently came across an article in the Canadian Real Estate Wealth online magazine that touched on an area that I believe is incredibly important to the mortgage applicants in Canada and the industry as a whole. Early in my mortgage education I realized that brokers are constantly standing up for the homebuyers in Canada, where as the banks are trying to protect themselves and their money, without fully understanding the homebuyer and their needs.

I recently came across an article in the Canadian Real Estate Wealth online magazine that touched on an area that I believe is incredibly important to the mortgage applicants in Canada and the industry as a whole. Early in my mortgage education I realized that brokers are constantly standing up for the homebuyers in Canada, where as the banks are trying to protect themselves and their money, without fully understanding the homebuyer and their needs. IBO Home Living ShowAll Your Home Advice, Under One Roof

IBO Home Living ShowAll Your Home Advice, Under One Roof Is Buying in Metro Vancouver Worthwhile?Part II – Considerations in Buying Real Estate

Is Buying in Metro Vancouver Worthwhile?Part II – Considerations in Buying Real Estate Is Buying in Metro Vancouver Worthwhile?

Is Buying in Metro Vancouver Worthwhile?